NIFTY Snapshot

Today’s Close: 7932.90 All time High: 8180.20 52 Week Low: 5700.95 Down from All time High: 3.02% Up from 52 week low : 35.82%

So as we see we are just 3% down from the top and people are crying as if market has crashed , but their crying is not without reason some(or most) are in deep losses . Reason? Definitely not a small correction of 3% ,then what ? There are multiple reasons :

- Most people sat on sidelines and made their positions on the top(this was definitely not all time top) and those people after booking losses will again do the same thing on some other top and in between market will be a bad place to be i for them.

- Even if they made positions on the all time top (say at exact mathematical top) , its down only 3% , but they make “huge” loss and the only reason behind that is their highly leveraged position . Appropriate quantity according to ones capital is never followed . On the sidelines I want to highlight the most important fact of our paid services is that I always suggest clients quantity according to every individual’s capital and that’s most important aspect of any of our paid service . A simple calculation is if you buy NIFTY by paying a margin of say 40000 on say 8100 you are leveraged 10 times and what most people do is they do it to the fullest of their potential meaning a 3% movement in their direction will make them richer by 30% and in case of opposite direction its -30% , and in that case they won’t be able to take the next position and will “try their luck in options” .

- Most people want to make quick by Options ,but they are good only when handled properly . And by proper handling it is not only meant that you buy the “right” call/put , it means you buy the right quantity, and also right strike and most important even if market is bullish or bearish to know whether to go for option or not as even after good spot movement options might not perform at all . The current example is 8000 NIFTY PUT suppose one bought on 2nd September expecting a fall in NIFTY , his/her trading direction (for small gains) might be right but that put was 80 that day and today also after almost 250 down from that day high of that put is 88 . And even if we consider extreme ,i.e. he bought that day on lowest price 56.25 (NIFTY fut high that time 8139) one can’t sell in mere Rs. 32 gain (even assuming he would have managed to sell at exact top) as in case off loss risk was that of 56.25 so its quite reasonable to expect similar returns. But on the contrary in just 2 days period if one had bought 8200 Call on 1st September at say Rs. 40 (low was 35.9 but I am picking 40 as in our paid service we had bought at that level and several trades were executed and confirmed at that level) on 3rd September the call made 84.9 but we take 80 as selling level (again reason same as above) call became double and NIFTY moved only 100 points. So the point is not to boast what I did but , whether to buy option or not and which one to buy.

There are different permutations and combinations of above three factors to make HUGE losses even in very little opposite market movement . And what my paid service separates from the free ones is not the quality of calls but the number of calls (actually lesser than in free service) and saving from above three .

Now we come to the trading setup, and further market direction .

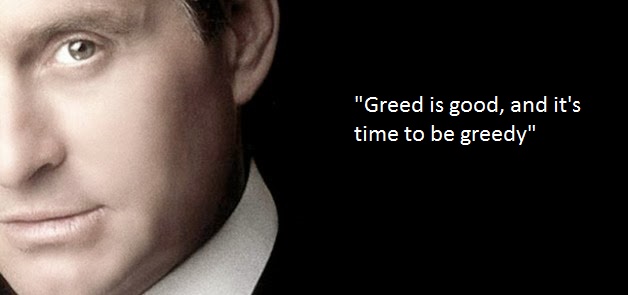

On that I have only few words to quote from Gordon Gekko : Greed is good and its time to be greedy . In plain words market rising has just started not ending here. And it has long long to go . The current rally has started from 7600 so we are just 600 points (at recent peak ) or 350 points at cmp into rally. Bookmark this post and watch after each 800 points rise starting 7600.

How to be successful in achieving that , again from Gordon Gekko : Buy my Service. As money can’t be made be made that easily , either put a lot of efforts of yours and and a lot of money for gaining experience or simply pay for that.